February 2020

New faces on campus

This month we have 3 new colleagues who joined the Augustana community. Please give them a warm Augustana welcoming when you meet them on campus.

Coming attractions

Junie B Jones Is Not a Crook.

March 1st, 1:30pm. Special employee pricing with pre-show snacks at 12:30p and a meet and greet with the cast after the show! Tickets are $5 for employees with a free child’s ticket! You can purchase the employee tickets here: https://app.arts-people.com/index.php?show_special=111166

For your benefit

As you may recall, our relationship with BeBetter ended on Dec. 31, 2019, as the college evaluates future directions for wellness and employee well-being. A number of folks have asked about other resources available for meeting their wellness goals. Our health network, Blue Cross and Blue Shield of Illinois, does have a portal available for your use at no charge. You can use Target onHealth to engage in health activities and earn points towards incentives. Here’s how to get started:.

Step 1: Register at Blue Access for Members or BAM by visiting bcbsil.com/member You’ll need your BCBSIL ID card to sign up. This site has a number for features including a provider finder, cost estimator, and electronic history of your claims.

Step 2: Select the My Health Tab and you’ll have the option to visit the Well onTarget site.

Step 3: The Well onTarget site will allow you to complete a personal health assessment and begin earning points as well as provided targeted programs based on your answers.

Step 4: As you engage in the program, you will earn points that you can redeem for a variety of items.

Also, during the month of February the Well onTarget fitness program is waiving the first month’s $25 charge that provides access to a large number of gyms and fitness facilities. To snag your free enrollment, log in to Blue Access for MembersSM (BAMSM) at bcbsil.com and search for the Fitness Program under Quick Links. You will need to enter the code “fit4feb” during enrollment to join for free before February 29.

If you try out this platform, we’d welcome your feedback!

Ask the Expert

At this institution of higher learning, we are a community of experts! And each of us also has knowledge unrelated to the office or department where we work. So, every month Augie Works will ask a campus expert to provide some advice or a how-to.

This month we ask:

It's tax time again and my inbox is filling up with offers from on-line programs to help me. When should you use a "real person" to prepare taxes vs. an on-line program? Or, is this something I can tackle on my own?"

Jacob Bobbit, CPA and Olivia Melton, CPA respond:

This is a difficult question to answer. There is no one set answer for when you should or should not prepare your own taxes. Much of the decision relies on your personal knowledge of taxes and confidence in your ability to complete the return on your own. That being said, we will do our best to provide some guidance and resources.

Many people are now taking the standard deduction when they previously itemized, which may simplify your return. The standard deduction this year is $12,200 for single individuals and $24,400 for married filing jointly.

If you are a resident of Iowa, you may still be itemizing on your state return even if you do not on your federal return as the standard deduction in Iowa is much lower than federal. If you are a resident of Illinois, some of the items may be includable as a credit on your state return even if you cannot itemize your federal deductions, such as real estate taxes.

Preparing taxes are like trying to build everyone a similar building out of Legos, but everyone brings you different bricks that all fit together in a unique way.

The online sites do a good job of asking key basic questions to help in preparing your return, but they may not be the right option depending on your situation and tax knowledge. If you have more complex tax situations, you may want to go speak with a tax accountant. Some of these situations include, but are not limited to:

- Moving, especially between states

- Buying or selling a house or other real estate

- Taking money out of retirement, other than normal retirement distributions

- Owning a rental property

- Estate transactions

- Investment gains/losses

- Owning a business

There are some options available if you are uncomfortable completing your own return. If your income is less than $56,000 you may be able to use the Volunteer Income Tax Assistant Program. To find out if your return would be in scope for this program, you may check this VITA website.

If you would like to try filing your own return with the help of an online program, the IRS lists different options based on your income level here. These sites may offer to file a state return as well; however, they may charge you for doing so.

You may file your Illinois return yourself for free here. You may be able to file your Iowa return yourself for free here.

We hope these resources help you in deciding which option is best for you. This does not constitute tax advice. Use your best judgement and seek out a tax professional if you are unsure about your tax filing.

--------------

Have a question you’d like us to ask an expert? Or some timely advice or bit of knowledge you’d like to share? Please send it to brittnidegreve@augustana.edu

Community and family news

Jon Miedema (head tennis coach) and his family celebrated the New Year by welcoming their new baby girl Wren into the world on Jan 2.

Angela'13 and Nick'13 Cummins welcomed their first child Oliver James on Feb 5. Angela is the daughter of President Bahls and wife, Jane.

The grandparents are just delighted to welcome the newest addition into the family!

To beat those pesky winter blues, human resources hosted Pop in & Play at the Pepsico Recreation Center. This was a great time for parents to get the kids to unplug and run around while playing soccer, basketball, bags, badminton and showing off their mad hula hoop skills.

Archery was a big hit! Here you can see Chris Beyer (res life) showing us how it's done.

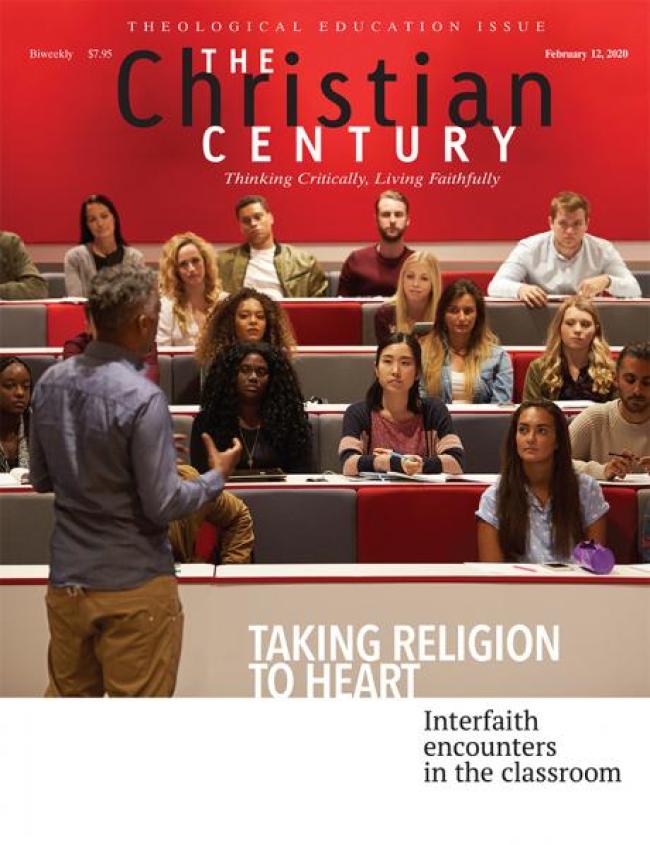

In the Feb 12, 2020 issue of The Christian Century you will find our very own Jason Mahn, professor in Religion, featured as the cover story. If you haven't yet seen it, we encourage you to read this insightful article on techniques he uses to get the students to be open in considering different religious traditions. Click here to read the full article.

In the Works is a monthly newsletter for Augustana College employees from the Office of Human Resources. The photo at the top is from our Winter, Young Professionals of Augustana (YPA) event hosted at The Bend, located on the 9th floor of the Hyatt Place in East Moline. If you have any questions or comments, please contact Brittni DeGreve, Office of Human Resources.